22 December 2021

5G is finally starting to gain traction after a stop-start 18 months. Robert Shepherd asks the experts about the towers and technology that facilitate its delivery against the backdrop of an unrelenting pandemic

Thanks to the Covid-19 global pandemic, supply chain disruptions, cost concerns and infrastructure sharing understandably slowed tower and small cell growth in 2020 around the world. As a result, projections and plans for 5G infrastructure and integration had to be adapted and re-evaluated across Asia-Pacific.

Nowhere was it felt more keenly than in southern Asia. Take India, the world’s fifth largest economy at the time of writing and closing in on China as the world’s most populous. The March 2020 lockdown imposed by prime minister Narendra Modi’s administration forced almost all people within and across different states to stop building new towers and cell sites. That meant the country’s operators, tower companies and other relevant players and to shift their focus to other things like maintenance work.

Mukesh Ambani, who is Asia’s richest man as well as the chairman and managing director of India’s largest private firm, Reliance Industries, recently upped the ante by declaring that 5G needs to be “India’s top priority”.

Head east and to a new entrant by the name of Dito Telecommunity in the Philippines, which began commercial operations in March this year also had to press the pause button on its tower building. The company said it only completed 300 of a planned 1,600 towers due to problems with the equipment it imports via part-owner China Telecom because of China’s lockdown in January 2020.

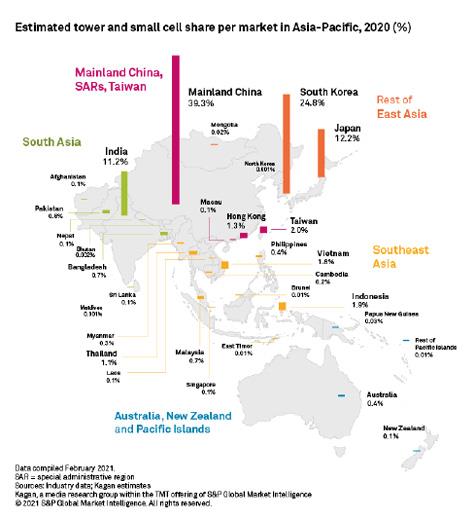

Research conducted by S&P Global called Asia-Pacific tower and small cell projections through 2031 and published in March 2021 says that operators and tower companies, however, remain bullish on tower growth for these two markets. “American Tower Corp. remains optimistic on its tower business in India, citing the consolidation of the tower industry and strong government support for digitalisation as significant growth drivers,” it says. “There is significant room for growth in rural areas where 4G penetration remains lower than the national average.”

Terence McCabe, chief technology officer, Asia Pacific & Japan at Nokia, says that while he would “rather not talk about specific customer engagements, it is worth pointing out that we do see an increase in the interest by tower companies in the role of ‘neutral host’ arrangements which extend beyond sharing of the tower real-estate” and include sharing of radio or baseband facilities using a range of technologies such as MOCN (Multi-Operator Core Networks) or MORAN (Multi-Operator Radio Access Networks). McCabe continues: “The increasing complexity of site design and the challenge of rolling out densified 5G networks increase the interest in network sharing to accelerate coverage footprints and contain OpEx growth. 5G does not specifically enable these developments, but the increased rollout activity creates an environment where these innovations become worthwhile considerations.”

McCabe adds that for the tower company, the question at hand is whether it has the means and interest in growing their value by taking a larger part in the rollout and operational management of the radio network. “For the mobile carrier, the issue is one of control versus cost, as a shared network requires compromises in deployment and reduces the scope for differentiation with their competitors,” he says. “There is certainly an opportunity for tower companies to play a greater role in the management of the complexity of site design and in environments where the difficulty of site acquisition is a critical factor, the tower company can play an important role in ensuring that 5G rollout is not delayed.”

“Aligned with the government agenda to cover population in Indonesia with 4G, for the last three years we put our focus to sunset 3G services and continue to expand our 4G coverage across Indonesia”

Vikram Sinha, Indosat Ooredoo

Meanwhile, the same S&P Global research explains that the government of the Philippines remains committed to its earlier target of building 50,000 additional towers with no specified timeline to improve connectivity. Indeed, it awarded at least 23 tower company licenses and expedited approval of tower building permits to support this goal. Incumbent operators Globe Telecom and PLDT vowed to ramp up infrastructure spending in 2021 to prepare for the entry of Dito.

“Pakistan and Vietnam are also seeing aggressive tower rollouts, whereas spectrum issues could curb growth in Indonesia, Malaysia and Thailand,” the report adds. “These developments could push total towers in southeast Asia and south Asia to grow by 6.72% and 4.76% CAGR, respectively, from 2021 to 2031.”

McCabe concedes that Covid had an impact on the rollout.

“One impact of the pandemic has been the realisation that ‘all networks have become critical networks’ as our residential broadband networks have become the basis not just of entertainment delivery, but have become the means to continue working, learning, and shopping while at home,” he says. “Some people will return to the office environment but the proportion of the workforce who ‘work from home’ has changed permanently in many countries. The potential to work as effectively from rural or urban environments has increased the awareness of the need for coverage and connectivity solutions that extend beyond urban cores. 5G as a compliment to fibre deployment is now becoming a reality in many markets and increasing the flexibility offered to consumers.”

When it comes to the impact of Covid on the roll-out of networks themselves, McCabe says “of course the challenge of maintaining safety in the workplace” for Nokia’s employees and contractors has been critical throughout the crisis, and there have been cases where the reduction in international mobility has created stresses. However, he argues that it has also proved a trigger for the increased adoption of digitisation tooling in network buildout. “We have been able to extend the reach of our experts through video connections with on-site engineers and innovations such as drone-based site survey has become more valuable in these new working circumstances,” adds McCabe.

Indonesia while perhaps not considered one of the powerhouses of southern Asia when it comes to 5G infrastructure and rollout, has been making quiet yet steady progress. In fact, Vikram Sinha, chief operating officer at Indosat Ooredoo, argues that his company is “at the forefront of Indonesia’s 5G revolution” and that it continues to support the government on Indonesia’s digital agenda.

“We have already launched commercial 5G services in Jakarta, Solo, Surabaya, Makassar and we intend to continue to rollout 5G in other cities across Indonesia,” says Sinha. “Aligned with the government agenda to cover population in Indonesia with 4G, for the last three years we put our focus to sunset 3G services and continue to expand our 4G coverage across Indonesia.”

In terms of progress, Sinha says he is “happy to share” that over 90% of Indonesia’s population are already covered with Indosat Ooredoo’s 4G services and most of its 4G BTS are 5G ready.”

5G was hyped and arguably arrived with more fanfare than any of its predecessors, with faster speeds and lower latency usually the main selling points. Yet while the next generation technology is no doubt a significant improvement on all that’s come before it, the true test is how it’s going to benefit society.

Sinha says his company believes 5G technology and its many use cases has the power to revolutionise Indonesia’s manufacturing industry, public services, healthcare sector and meet growing consumer demand for digital content and entertainment services over mobile networks.

What’s more, Sinha has some examples to share as Indosat Ooredoo is exploring a wide range of advanced 5G use cases.

“They include connected cars and in-car entertainment services, smart surveillance technologies such as drones and smart CCTV, smart electricity that automatically detects faults in household circuits, healthcare applications that involve remote monitoring and entertainment applications such as mobile HD video, 360 video and virtual reality,” he says. “As part of Indosat Ooredoo’s growth strategy we refocused the business on digital products and services and transition to an asset-light model. In-line with this strategy, in March 2021 we announced a deal to sell and leaseback more than 4,200 of our telecommunications towers in one of the largest transactions of its kind in Asia, valued at around US$750m.”

While the drive and wherewithal are there to make 5G a success, a lot of money has been spent on existing infrastructure. Can these towers and the kit that facilitate cellular connectivity be used, or do they have to be uprooted and replaced in their entirety?

McCabe says the degree of change to existing tower facilities “has much to do with the existing site infrastructure and the priorities of the mobile operator”. He explains how much of Nokia’s deployed radio infrastructure is ‘5G ready,’ meaning that software upgrades are available to allow 5G NR (New Radio) to be rolled out on existing equipment and existing spectrum with disruption.

“However, the rollout of 5G is often associated with new spectrum allocations and may require additional radio and antenna deployment,” he warns. “Where the new spectrum is in the mmWave bands, the need to facilitate line-of-sight connections and short propagation paths typically requires a small-cell rollout plan in which existing towers play a reduced role.”

McCabe also explains that “a key factor” in any 5G rollout is planning for backhaul facilities capable of supporting the bandwidth demands of intense broadband usage.

“Typically, this will require fibre connectivity to extend to more sites with only the rural edge supported by microwave,” he continues. “Likewise, the aggregation of these sites will require a backbone optical network capable of significant growth, so if that does not exist today, the development of a robust and extensible optical network is critical to success of the 5G rollout.”

Singapore is presently leading 5G development in southeast Asia, but telcos in other parts of the region have announced merger deals worth a combined US$30bn this year. While this has been done to enlarge their market clout and improve profitability, it’s good news for 5G infrastructure investment.

Terence McCabe, Nokia

“Typically, this will require fibre connectivity to extend to more sites with only the rural edge supported by microwave”

Recently announced deals include Thailand’s True, the second-biggest mobile operator that is owned by the country’s largest conglomerate Charoen Pokphand, joining forces with Dtac, owned by Norway’s Telenor. In Indonesia, south-east Asia’s biggest economy, Qatar-based Ooredoo and Hong Kong’s CK Hutchison, the two largest operators, are set to combine in a US$6bn deal the regulators are expected to approve by the turn of the year. In Malaysia, regulators are poised to assess a US$15bn megamerger between local firm Axiata and Telenor, which would create an industry leader with a 46%-50% market share, according to estimates by Fitch Ratings. In 2019, Cambodia’s regulator signed a deal with Chinese giant Huawei to deploy infrastructure in the country by 2020.

img6

It’s clear that sector consolidation has been gathering pace globally, as companies pursue scale to defray the costs of investing in 5G and full-fibre broadband networks.

Good to hear that 5G, all things considered, is powering on and that companies are, in a way, sharing the costs. Does that mean 6G could be here sooner than we think?

While you may scoff at the thought and say that we haven’t even cracked 5G yet, South Korea and the US are just two countries already making major inroads. When it does arrive, will the 5G tech work for 6G or is it all 5G specific?

“Firstly, we are still a decade out from 6G, with the intended commercial deployment to begin in 2030, but the expectations are already being set for what the technologies of 6G involve,” says McCabe. “Before that comes, we still have significant development to come in 5G and 5G Advanced which will bridge current networks to the 6G future. While today’s 5G deployments have focused on enhanced mobile broadband coverage, further enhancements to both latency and reliability as well as the addition of non-terrestrial networks.”

McCabe concludes by suggesting that the rollout of 5G is an opportunity to survey the legacy tower equipment with a view to power efficiency and future extensibility. “Likewise, the re-farming of existing spectrum for 5G NR deployment creates opportunities for consolidation of tower footprint,” he says.