08 April 2024

Sanjeev Verma, CEO, Squire Technologies

Mobile networks will become increasingly complicated as operators invest in standalone 5G (SA5G), despite switching off 2G and 3G. Without signalling interworking between 4G and various 5G types, network management will be challenging, and consumers will experience poor connections, jeopardising profits.

In GSMA’s ‘Network Slicing Use Cases Requirements’ report, experts state: “…the requirements of verticals are many and diverse, and operators would need to manage a high level of risk in the complexity of their service offering and cumbersome management, driving up costs.”

Mobile network operators (MNOs) have numerous obstacles to overcome. Non-standalone 5G (NSA5G) bolted on to 4G LTE, convoluted SA5G deployment strategies, and SA5G diversification opportunities will create hugely varied networks, complicating management. However, there are reasons to be optimistic. While many are lauding the role SA5G will play in businesses, these network changes might also radically alter how subscribers perceive mobile technology. Altogether, it could shake up the entire industry. Giants will be felled, new sectors will emerge, along with new leaders, and the great, decades-long commoditisation of the mobile market will end.

The end of the mobile industry’s race to the bottom

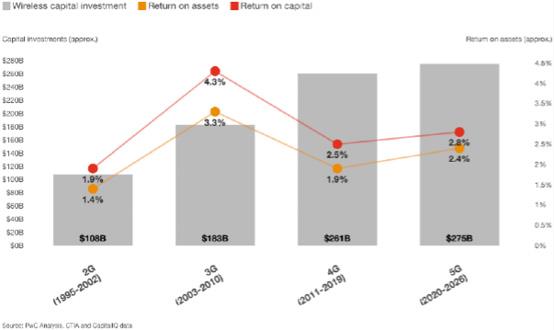

MNOs have been in a bloody fight for a long time according to Strategy& from PWC, resulting in a race to the bottom and years of thinning profit margins. Their report and those of MTN Consulting and Ofcom show how the market has been commoditised and focused on cost-cutting and price differentiation as subscribers increasingly get more data for less money.

However, things may change as SA5G offers more paths for differentiation strategies. For the first time in years, MNOs and mobile virtual network operators and enablers (MVNO/Es) could move away from low-cost strategies, sparking a de-commoditisation of the market of ubiquitous contracts and bundles.

Unfortunately, to get to this ocean of opportunities, MNOs must first navigate turbulent waters as they establish new networks and upgrade existing ones. It is expected to be costly and will result in complicated networks.

Why will networks be more convoluted?

Some governments are reluctant to invest in the expense of rolling out SA5G. The challenges of monetising 5G are likely the cause of their reluctance. PWC describes these challenges as often occurring due to consumer beliefs that quality mobile services should come at low prices.

Therefore, to afford rollouts, MNOs will probably adopt typical deployment strategies that focus on high-consumer areas first, like cities. Doing so will likely create an SA5G patchwork, where subscribers lose their SA5G benefits as soon as they leave an area of coverage. It has been a similar situation with 4G.

Returns on capital invested across different network generations

Still, it is possible to cover large areas with SA5G. GSMA’s guide to 5G spectrum shows how MNOs can opt for different types of 5G that sacrifice network speeds for more coverage. While mmWave 5G has the least coverage and difficulty penetrating concrete, it offers ultra-reliable low latency connections and massive Internet of Things device capabilities (IoT). Transport hubs, stadiums, and other high-population areas will benefit from mmWave 5G, and it could spur a wave of innovations and job creation as phones turn into revenue-generating devices.

Arguably, this presents one of the best sales options for MNOs wanting to convince subscribers to upgrade to SA5G during a time of global inflation. If successful, it could open the way for a surge in individuals using their mobile devices for business. Forbes has documented an explosion of content creators and influencers, and SA5G will make this an attractive path for anyone with a mobile phone. To this end, operators that want to differentiate should stop viewing subscribers as end users and start looking at them as budding entrepreneurs.

Similarly, the diversification of networks sets the stage for an upswing in new MVNOs. MVNO Nation reveals how niche market opportunities are emerging for radical MVNOs to exploit. However, the array of new uses will create a granular network of spectrum layers and slices, transferring ever-larger amounts of data and creating disorder for network management.

How will network management change?

Network slicing will be central for competitive business strategies that seek to use the versatility of SA5G. Slices of networks tailored for hospitals, schools, content creators, connected cars, or the private networks of individual businesses will offer a multitude of revenue paths for MNOs, and create masses of network connections to manage.

According to recent insights from Qualcomm, coverage and connectivity are the top concerns of mobile subscribers. So, an unreliable network could damage brand perceptions and revenues. If MNOs want to keep consumers happy, they must optimise their networks.

As 4G didn’t replace 2G and 3G, 5G will not replace 4G. Therefore, multi-generation and multi-band networks and spectrum slices must integrate and work seamlessly to deliver the experience consumers and businesses expect. In this regard, there are opportunities to improve efficiency and reduce costs while upgrading to SA5G.

Using existing infrastructure, similarly to how NSA5G uses 4G LTE infrastructure, operators can reduce SA5G rollout costs. By utilising signalling interworking between 4G and 5G networks, operators can save money and provide reliable coverage and connectivity to customers.