04 December 2023

FWA has been making the headlines in recent years as an alternative connectivity solution to shore up the digital divide. However, reports suggest that it may be little more than a stopgap…

Fixed wireless access (FWA) is taking the world by storm, and southern Asia is no exception.

The GSMA reports that as of March 2023, 17 operators in eight Asia Pacific countries offered 5G FWA services. Markets where the fixed broadband technology mix is skewed towards xDSL, such as Australia, and those with low total fixed broadband penetration, such as the Philippines, are expected to lead the growth of 5G FWA in the region.

Need for speed

We live in an age where demand for higher connectivity speeds is growing at an unprecedented rate; 5G is expected to play a key role.

“The demand for speed is driven by the increasing need to support advancements in digital content, such as 8k video streaming, making higher broadband speeds essential to meet these demands effectively,” says Yisrael Nov, EVP, sales, Parallel Wireless. “Video streaming transitioned from 4k to 8k resolution - requiring a fourfold increase in broadband speed to effectively manage the augmented data volume. Users engaging in 8k streaming experience increased bitrates (data transfer rates) to facilitate content downloading while maintaining superior quality. As a result, the increase in data requires more bandwidth to support it.”

The GSMA data predicts that there will be 1.4 billion 5G connections in Asia Pacific by 2030, accounting for 41% of all mobile connections. The region’s operators are investing US$259 billion on their networks – mostly on 5G deployments - over 2023-2030.

FWA vs fibre – no competition

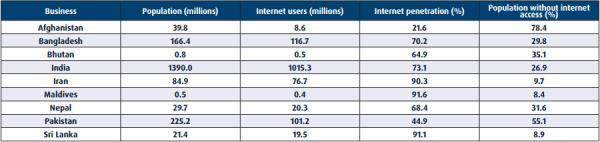

Southern Asia has a broad range of topology – from dense, urban cities to sparsely populated remote and rural villages, among others. According to the ITU, more than 25% of the population remains without internet access in several southern Asian countries, due to factors including environmental, demographics, infrastructure development, and economic conditions. The spread of FWA – in comparison to competing technologies like fibre and satellite – depends to a significant level on these factors.

FWA is being touted as an affordable solution for those in lower income and underserved regions, in particular: “FWA tends to be more cost-effective and faster to deploy than fibre, especially in areas with limited fixed infrastructure. FWA can be a solution for regions where laying fibre optic cables is challenging due to geographical constraints, regulatory hurdles, or high costs,” says Richard Pak, CEO, Curvalux.

In the competition with fibre, the latest 5G and WiFi 6 and 7 advances mean that FWA can offer a viable alternative, which is continually improving. However, Ron Ng, chief business officer, Curvalux, reports that “the presence of fibre may influence pricing and competition in the broadband market. FWA providers may need to offer competitive pricing and services to attract and retain customers in areas where fibre is well-established.”

Nevertheless, FWA offers a substantially faster time to market than competing technologies. Fibre infrastructure, for example, is labour intensive, time consuming, and faces regulatory challenges including zoning, right-of-way approval and local permits, as well as requiring the installation of conduits and utility poles. FWA can also serve as a solution in areas where the ‘last mile’ connectivity is the main challenge, says.

Despite the overarching benefits of FWA, fibre remains Asia Pacific’s leading broadband technology of choice – by a long shot. As per S&P Global Market Intelligence, the region had 596.5 million fibre broadband connections in 2022 – expected to grow to 726 million by 2027 - with a 50.7% household penetration rate. In contrast, FWA subscribers for the region numbered 9.3 million, while satellite had 237,000 subscribers.

Monetising the network

While network modernisation and the move to 5G remains a priority, the matter of monetisation is becoming increasingly pressing amidst stalling core service revenues. According to the GSMA, 5G FWA has ‘the potential to drive incremental revenue opportunities for operators.’

FWA will be of particular relevance in markets where fixed broadband is still based on DSL technologies, and in markets with low overall fixed broadband penetration, like the Philippines – in May, Globe Telecom reported that it generates 25% of its home broadband revenues from FWA. Indonesia and Thailand will also be key markets for 5G FWA, says the GSMA.

So how exactly can FWA help monetise the network?

On the quest to meet rapidly expanding demands for high-speed connectivity, FWA availability naturally represents an excellent money-maker for operators, since broadband enables users to consume more data, increasing revenue from data usage. Moreover, “as more devices and applications require high-speed internet, the demand for data is growing; operators can capture a larger share of this growing market by providing FWA broadband,” adds Pak.

FWA can also help mobile operators better utilise their existing infrastructure, with cell towers and backhaul networks being put to additional task to deliver additional services. By providing broadband access to areas where it might be difficult or expensive to lay traditional wired infrastructure, operators can use their resources more efficiently.

With these expanded service offerings, “MNOs can offer additional broadband services to their customers with FWA solutions,” says Ng. “MNOs can bundle their existing mobile offerings with home and business broadband services. This diversification of services can increase revenue streams and customer loyalty. It is also proven that customers with bundled products may be more likely to stay with the provider. This can help retain customers and reduce the revenue loss due to customers churning to other providers.”

When it comes to spectrum challenges, which remain a topic of much discussion the world over, FWA operating on non-mobile spectrum – like unlicenced 5GHz – can also provide a handy offloading solution for mobile networks.

“It can help alleviate congestion in heavily loaded mobile areas by offloading some data traffic onto the fixed wireless network, thus improving mobile users’ overall quality of service,” says Ng. “Other than this, non-mobile spectrums fee to the regulator is typically much cheaper than mobile spectrums.”

Finally, in the continual search for new sources of revenue, “MNOs can explore partnerships with WISPs or offer wholesale access to their network infrastructure. This can create additional revenue streams by selling access to their existing network to other providers or entering into revenue-sharing agreements,” adds Pak.