05 December 2022

Value added services have changed the world, offering a wealth of game-changing services for enterprises and consumers alike. Uptake skyrocketed during the pandemic; however, challenges remain in adoption and monetisation across Southern Asia, says Amy Saunders

Profitability in core mobile voice services is falling globally, with prices approaching commodity levels.

“Increasingly, revenues and margins from voice services have flatlined for carriers in APAC,” said Arun Mathew, VP business development, Cookies Digital.

“MNOs worldwide keep investing in faster speed, lower latency, and greater capacity of their networks. Southern Asia is not an exception to that. Revenues are no longer driven by voice services, but by data consumption,” said Leon Dijksman, director of PR & communications, Sam Media.

Value added services (VAS) have emerged as a significant tool for MNOs to cross sell additional services to customers, enhancing revenues, growing average revenue per user (APRU), and increasing customer retention. Moreover, the use of VAS drives mobile phone usage in turn, providing a boost to core mobile voice and data consumption, again helping boost revenues.

“Consumers can’t wait to use the full potential of web 3.0,” states Dijksman.

“Carriers have positioned themselves to benefit from the explosion of data being available for users, cheaper and faster across the APAC region,” said Matthew. “One of the biggest use cases to benefit from this would be content services and content related products that will drive data consumption and ultimately create a subscription economy for the carriers. VAS are in prime position to deliver this value to the users and the margins to the carriers.”

VAS are booming the world over. According to Report Linker, the global mobile VAS (MVAS) market is expected to expand at a compound annual growth rate (CAGR) of 14.4% over 2022-2028 to US$1652.9 billion. The COVID-19 pandemic had a predictable positive impact on MVAS adoption, with social distancing and stay-at-home instructions encouraging the uptake of digital services such as online shopping, mobile money, and over the top (OTT) media services, including video and gaming. The latter – OTT services – is proving particularly helpful in driving demand for MVAS across the globe as content consumption booms. Report Linker found that the Asia Pacific market was the leading region for MVAS in 2021, with many mobile phone users accessing services like mobile banking, infotainment, and news.

Despite global rising interest rates and inflationary pressures and geopolitical tensions – or perhaps as a means of escapism from - there exist huge opportunities for MNOs in the VAS space in Southern Asia.

However, to truly capitalise upon the increased demand for VAS, mobile internet adoption must be expanded. The GSMA states that mobile penetration in the Asia Pacific was just under 45% at the end of 2021, even though mobile broadband networks cover 96% of the region’s population. Thus, more than half the population has access but does not yet subscribe to mobile internet services, primarily due to a lack of digital skills, lack of affordability, and online safety concerns. Said concerns are not unfounded; in Thailand, 56% of cyber threats in 2021 occurred via vulnerabilities in mobile devices, rendering security a key concern for MNOs.

With 5G rolling out across Southern Asia, monetisation of that investment is a top priority. GSMA Intelligence’s consumer survey found that users are increasingly interested in adding content and services like video streaming, music, gaming, live sports, cloud storage etc., to their 5G plans. Operators are duly making efforts to promote such services to remain competitive and cut customer churn. For instance, Bharti Airtel has implemented immersive video technologies over its 5G test network to recreate famous historical cricket matches in India, while in the Philippines, Smart Communications has teamed up with Oppo to explore and develop 5G use cases like immersive media.

Mind the gap

Despite strong regional growth, the adoption of MVAS is unequal throughout Southern Asian countries.

The gender gap between mobile internet adoption has been closing gradually throughout the region, however, progress has stalled in some countries, reports the GSMA. In South Asia, the mobile internet gender gap fell from 67% in 2017 to 36% in 2020 but grew to 41% in 2022. The GSMA attributes this to continued adoption among men without corresponding adoption growth from women. Notably in India, mobile internet use grew from 45% to 51% for men but remained flat at 31% for women.

Pakistan has made strong efforts to close the gender gap, with initiatives like the ‘Connected Pakistan: Accelerating Gender Inclusion in ICTs’ event and the signing of a Memorandum of Understanding (MoU) with the GSMA to collaborate on reducing the digital gender gap. Moreover, the Pakistan Telecoms Authority (PTA) has established a Gender Committee and is collaborating with MNOs and relevant social enterprises to fast-track the efforts to reduce the gender gap.

One particularly significant MVAS which is delivering huge positive socioeconomic results, as well as significantly augmenting MNO revenues, especially in low- and middle-income countries (LMICs), but which is also home to a significant gender gap, is mobile money. Digital financial services like mobile money are widely considered to have kept these economies afloat during the difficult COVID-19 pandemic years, and online payments for the region are expected to exceed US$1 trillion by 2025.

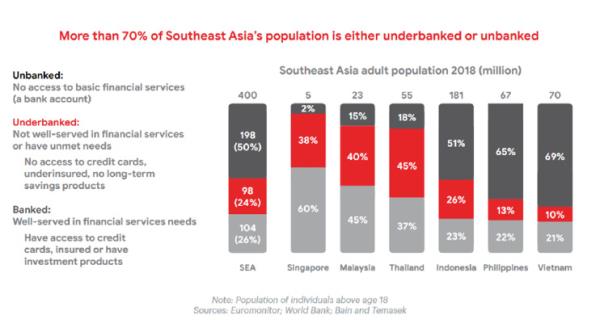

Data from Euromonitor, the World Bank, Bain & Co, and Temasek states that more than 70% of Southeast Asia’s population is unbanked or underbanked: 79% in Vietnam, 78% in the Philippines, 77% in Indonesia, 63% in Thailand, 55% in Malaysia, and 40% in Singapore. This situation is creating the perfect environment for mobile money to flourish, supporting informal businesses, and in theory enabling financial inclusion to any adult with a mobile phone and internet access.

“While Southeast Asia’s economy has come a long way in the last decade, over six in ten southeast Asians remain underbanked or unbanked today,” said Dijksman. “The good news is the digitalization of financial services has provided new tools to solve persistent barriers to financial inclusion, and Southeast Asia is well-placed to benefit. With carrier billing MNOs can play an important role in solving this.”

However, mobile money uptake has been limited in some countries where a strong preference for cash or else heightened security concerns remains, such as in Indonesia and India. Mobile money fraud is a huge and growing challenge, with increasingly sophisticated attacks taking place globally; MNOs, service providers, policy makers and government must all join forces to enhance security in a holistic manner to continue to drive adoption rates and increase trust in services. However, additional security measures must be balanced against convenience, with analytics company FICO reporting that 37% of Malaysians abandoned attempts to open a savings account due to time-consuming ID checks and a further 26% reduced their account activity due to annoyance with frequent security checks, according to survey respondents. A careful weighing of what is necessary to protect enterprises and consumers from bad actors compared with inconvenience must be made.

Mobile money uptake is also seeing a significant gender gap in Southern Asia, comparable to that on the African continent. In Bangladesh, a relatively mature mobile money market, 84% of men own mobile phones, while just 65% of women own a mobile phone, resulting in a 23% gap in mobile money account ownership. Meanwhile, in Pakistan, the mobile money account ownership gender gap is a whopping 71%. Greater efforts are required to ensure that women in Southern Asian nations are afforded the same opportunities for financial inclusion as men. For instance, in Pakistan, Ufone has introduced several initiatives to increase female access to connectivity, including a smart code that allows women to receive mobile top-ups without having to share their phone numbers with retailers.

It’s all fun and games

Gaming is emerging as a leading MVAS throughout the world, delivering immersive, entertaining content for consumers. Globally we’re seeing a shift from consoles to mobile devices among the gaming community, which offers huge new monetisation opportunities for MNOs and service providers. Naturally, the rollout of 5G is playing a huge role in this evolution thanks to the high speeds and low latency, a requirement for most online games.

“VAS providers have always been innovative,” said Matthew. “From bringing content to early adopters to providing mass entertainment through VOD and OTT offerings, VAS has and should remain the central repository for consumers to try new content and low ticket entry prices. VAS providers focusing on video and gaming will continue to remain popular across the board.”

As per Statista, Indonesia led the pack in Southeast Asia on mobile gaming in 2021 with 59.8 million subscribers, with expansion to 76.9 million expected by 2027. The entire region had some 78 million mobile gaming subscribers in 2021 – this is expected to almost double to nearly 140 million by 2027.

Throughout Southeast Asia, the affluent gaming demographic is growing exponentially. The youthful population and the increased adoption of smartphones – shipment levels in Indonesia, Thailand, the Philippines, Malaysia, and Vietnam are now back to 2019 levels as per Counterpoint Research – are helping boost interest and subscriptions across the region. These consumers, with money to burn, could prove especially valuable to MNOs should they be targeted appropriately. During the fourth quarter of 2021, mobile gaming grew by 270% year on year and today there are more than 102 million active mobile gamers in Indonesia, Thailand, the Philippines, Malaysia, and Vietnam.

Growth in mobile gaming has been attributed to increased 5G rollout, investments in internet penetration, rising rates of smartphone adoption, wider choice among game content, and increased levels of free time from multiple COVID-19 lockdowns. Indeed, the pandemic may have been the single largest contributing factor to the growth of mobile gaming, and other MVAS, in recent history. Inmobi reports that a staggering 46% of Indonesians started playing mobile games during COVID-19.

Interestingly, mobile gaming patterns seem to mirror traditional console gaming in being dominated by committed rather than casual gamers; in Indonesia, some 83% of mobile gamers play once or more a day, compared with just 10% playing at least once per week, and 7% once per month or less. This level of commitment brings with it huge monetisation opportunities for MNOs, both in terms of increased data use, in-game advertising, and in-game purchases.

Adapting to the rise in mobile gaming, Singapore’s MNO M1 formed an exclusive partnership with Blacknut earlier this year to offer an ‘all-you-can-play’ 5G-streamed cloud gaming service with 450 games that can be accessed seamlessly across any device. Meanwhile, in India, Jio has trialled high-definition VR-enabled multiplayer cloud gaming ahead of the commercial launch of its 5G network. For MNOs to benefit from the rise of mobile gaming across Southern Asia, the rapid implementation of exclusive partnerships and original content is a must.

Driving increased adoption

Expanding the MVAS user base is an essential step forward for MNOs and service providers across the world to maintain a strong business case in a highly competitive market. However, there are a wide variety of challenges to consider, which might best be addresses with increased cooperation between value chain participants.

“Service providers and MNOs have already been building a successful template in providing content and VAS to subscribers in Southern Asia,” said Matthew. “In order to bring better and new world content and VAS to the users, MNOs and service providers will have to work closely to bring about additional channels for content discovery, hard and soft bundling, BNPL and other mechanisms to ensure content and VAS remain an affordable option for the users, and also remains a key component of the subscription economy.”

Dijksman agrees: “while MNOs are investing in data capacity (e.g., 5G), service providers are working on personalized content to serve consumers better. Service providers can offer data consuming products that are engaging, bringing business to both MNOs and service providers. MNOs can work together on marketing, content placement and many more aspects.”

“VAS have always been at the forefront of bringing diverse and discoverable content for consumers in Southern Asia. Backed by carriers, VAS operators have been driving a value based model, offering users access to content and services in exchange of simple and effective subscription based pricing, a form of buy now pay later in its formative stages,” said Matthew. “But with the advent of high value content, video streaming and esports related content which come with a high price tag, some of the cost will have to be transferred to the users. Minimizing the cost transfer and remaining effective in bringing world class content at cheaper prices will be amongst the biggest challenges in delivering VAS in Southern Asia.”

Connectivity is the bedrock of MVAS; in regions like Asia Pacific where 96% of the population is covered by 3G, 4G or even 5G mobile networks, uptake should be through the roof. Alas, this isn’t the case. The GMSA reports that just 45% of Asia Pacific’s population is connected to mobile internet, rendering a usage gap of 51%. Addressing this gap will take concerted efforts by MNOs, service providers, device manufacturers and content creators, and it won’t be fast; the GSMA expects just 52% of Asia Pacific’s population to be connected to mobile internet by 2025.

While internet connectivity itself is obviously an essential, some MVAS require the faster speeds delivered by 5G for optimal functionality. For instance, Netflix recommends 15Mbps download speeds to watch 4K/UHD video content, which is beyond the average 8-10Mbps for 4G mobile connectivity. Mobile gaming, too, requires 5G in many instances to run smoothly with low latency, or risk consumer frustration. Although MNOs have been eager to rollout 5G across the world, progress has been faster in some regions than others.

Indeed, commercial 5G services have been launched in Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand, Vietnam, India, Bhutan, the Maldives, and Sri Lanka, but are by no means available nationwide. Brunei’s commercial 5G network is, at the time or writing, entering its trial phase. Papua New Guinea’s populace has 5G via satellite through a partnership between SES and Vodafone PNG. Cambodia, Myanmar, Timor-Leste, Bangladesh, Nepal, and Pakistan are yet to host 5G services, although many have plans in the making, some of which have been delayed by geopolitical unrest.

The GSMA states that by 2025, there will be more than 400 million 5G connections in Asia Pacific, just over 14% of total mobile connections. The figure will be higher (67% on average) in developed Asia Pacific nations like Australia, Japan, Singapore, and South Korea. Progress, therefore, will be considerable, but not a landslide.

Playing a vital role

It’s clear that MVAS have a vital role to play in the digital economy, in South Asia and indeed across the globe. Services like mobile money, OTT, messaging, music, and gaming are already changing lives for the better the world over, for both infotainment and essential life tasks such as banking.

Enabling digital and financial inclusion, helping bridge the gender gap that still exists in so many parts of the world, and delivering essential (and non-essential) services to those who were previously unconnected are just some of the achievements that can be made with MVAS.

Duly, MVAS is expected to thrive in southeast Asia and the world at large for the foreseeable future. “We expect substantial growth as we can reach more and more people with personalized content driven by AI,” said Dijksman.

As well as benefiting consumers and helping enterprises gain new customers and enhance experiences for existing clientele, MNOs stand to gain by augmenting their business case with new revenue sources. This is particularly valuable as basic connectivity prices drop everywhere, with both cellular and satellite capacity nearing commodity-level pricing, helping MNO business plans remain viable for the foreseeable.

“VAS providers and MNOs are well positioned to become the marketplace of choice for consumers to discover, try and enjoy content,” said Matthew. “Especially for users who are new to the world of esports, cloud gaming, VOD, they will continue to demand and expect high quality content at affordable subscription pricing. Catering to this demographic and to continue innovating will be a key component of this partnership and I truly believe this will be the cornerstone on which VAS providers and MNOs will succeed.”