22 December 2021

Geoff Bennett, director, solutions and technology, Infinera explains how submarine cable systems point the way to economic growth

It’s estimated that submarine communication cables facilitate over $10 trillion USD in global trade per day. For rapidly growing regions of the world like Asia and Africa to have full access to this flow of digital commerce, they need to have reliable, high-capacity subsea cable connections. This is even more important as the epicentre of internet traffic shifts away from the U.S. and toward a far more equitable balance of traffic around the globe.

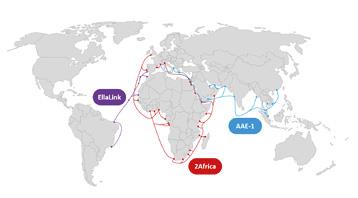

In response to this need, in recent years we have seen new, high-performance cables providing higher capacity and lower latency for connections between Europe, the Middle East, and Asia, as well as new direct cables between Europe and South America.

The longest submarine cable in the world today

The Asia-Africa-Europe-1 (AAE-1) cable is a great example. A 25,000-km cable system that connects Southeast Asia to Europe via Egypt, it is the largest submarine cable to be constructed in almost 15 years. AAE-1 is a modern cable design, optimized for the latest generation of high-performance coherent subsea transponders. These are the active transmitter/receiver devices that are plugged into either end of the cable, and which inject high-data-rate optical signals at over 100 Gb/s per wavelength, with an initial design capacity of 40 Tb/s for the cable.

Note that, while a submarine cable has an engineering design life of about 25 years, transponder evolution occurs in roughly four-year cycles, so new transponders can be deployed on existing cables to give them a mid-life boost in capacity. For example, over the past 20 years, the capacity of trans-Pacific subsea cables has increased by a factor of 357 times. But over that period, only 12 cables were laid. Most of that capacity growth has been achieved by submarine transponder evolution.

The Asia connection

According to the same source, growth in demand for capacity in the Asia region is only marginally lower. Intra-Asia routes alone are forecast to receive US$1.6bn in investment in new cables over the next three years.

The Asia region demonstrates that geopolitics shapes markets as much as technology change and demand. Plans by several providers to land trans-Pacific cables in Hong Kong were severely disrupted when the U.S. government denied a licence to Pacific Light Cable Network, a Chinese-owned operator, to land part of its cable in Hong Kong. Fearful of similar restrictions, other operators with plans to land cables in the territory began to withdraw their landing licence applications.

The impact of this affair on Hong Kong’s economy would be difficult to exaggerate. While the territory has long enjoyed a powerful position as an intra-Asia hub, it is only currently connected to a single trans-Pacific cable and a key aspect for submarine connectivity must be resilience – especially where cables need to be laid within the geologically active “Ring of Fire” regions.

Not only was this a blow to Hong Kong’s prospects of expanding its role in international connectivity, the move to thwart PLCN prompted rapid redrawing of plans by other operators. Hong Kong’s loss, meanwhile, may be a gain for Singapore and other Asian countries.

Architecting submarine networks for data security

Given that data security represents one of the 21st century’s most important strategic assets, it should come as no surprise that governments are taking seriously inherent risks associated with submarine networks and pushing for stronger security measures. For example, the U.S. recently launched The Clean Network initiative, which includes a Clean Cable working group tasked with assessing what a “secure” submarine cable looks like and ensuring that undersea cables around the world are not subject to compromise, including by foreign governments looking to exploit weaknesses for intelligence-gathering purposes. Earlier this year, over 20 European Union (EU) Member States committed to strengthening internet connectivity between Europe and its partners in other global regions by signing the Declaration on “European Data Gateways as a key element of the EU’s Digital Decade,” an initiative that includes increasing focus on submarine cable security and dependency risks. In addition to architecting for higher capacity and increased performance, data security is playing an increasingly critical role in how submarine networks will be designed and built moving forward.

Putting content on the map

Telecommunications market research firm TeleGeography earlier this year published a map of the world’s submarine cables showing 464 cables and 1245 landing stations. The map helps to visualize the extent and pace of the market as well as its changing dynamics. The 19 new cables added to the 2021 edition of the map alone add a further 103,348km to the global supply – enough to circle the earth two and a half times – boosting the total to 1.3 million km. The link between this new capacity, the boom in data centres, the growth of public cloud services and increasing consumption of online content is clear. By 2020, content providers – the likes of Google, Amazon and Microsoft – accounted for 66% of total capacity. These same companies are becoming significant investors in subsea cable as well as data centre infrastructure.

In conclusion

Submarine cable systems are vital to the digital economy worldwide. In the past, so much of this activity was centered on the US but now Asian, African, and South American routes are increasing in capacity, with an explosion of local data centres and an increasing diversity of landing points.

The future is bright for these growing economies to grasp the opportunity to recover in the post-Covid world.